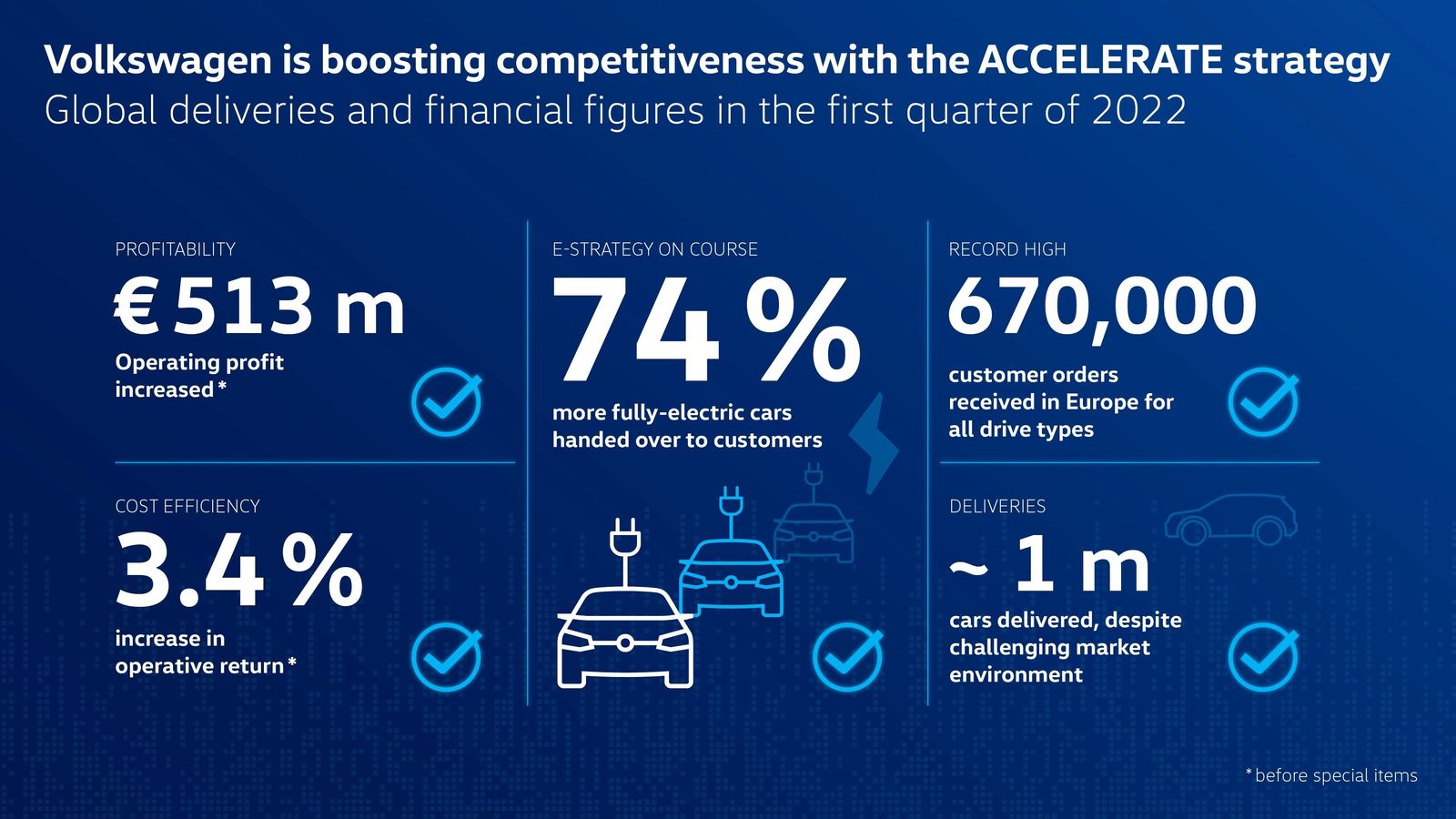

- First quarter of 2022: operating result increases to EUR 513 million

- Operating return on sales rises to 3.4 percent

- Electric mobility strategy on track: 74 percent more all-electric cars delivered

- Demand remains high – backlog of orders at all-time high

- Volkswagen CEO Ralf Brandstätter: “A sustainable improvement in economic efficiency gives us a solid basis for our accelerated transformation to emission-free and fully networked mobility”

The Volkswagen brand strengthened the Group’s economic efficiency sustainably lastingly in the first quarter of 2022. In the first three months, the operating profit before special items increased to EUR 513 million (Q1 2021: EUR 490 million). Sales revenue came in at just under EUR 15 billion (Q1 2021: EUR 17.6 billion) due to an optimized model and price policy, while the number of deliveries in the same period came in at around one million vehicles (Q1 2021: 1.36 million) due to the war in Ukraine, the global semiconductor shortage and the most recent coronavirus measures in China. In contrast, the operating return on sales before special items rose to 3.4 percent (Q1 2021: 2.8 percent).

“We further improved our economic efficiency in a difficult environment. This underscores that Volkswagen has chosen the right path for achieving a lasting improvement in its competitiveness and profitability with the ACCELERATE strategy. We have therefore laid a very solid foundation for the accelerated transformation to zero-carbon and fully networked mobility,” says Volkswagen CEO Ralf Brandstätter.

Continued focus on cost efficiency – outlook for 2023 confirmed

Volkswagen is continuing to work hard on improving its cost efficiency – for example on further reducing its fixed costs and overheads – in order to strengthen its competitiveness long term. “We are currently facing different challenges such as the geopolitical uncertainty, commodity and energy price hikes and the effects of the pandemic in China. We’re working to counter these risks with our cost-cutting measures and by improving the quality of our operating result in specific areas. However, we’re sticking to our target of an operating return on sales of 6 percent in 2023,” said Volkswagen CFO Alexander Seitz. This forecast is contingent on how the war in Ukraine evolves and in particular on its impact on the global economy and thus on the Volkswagen brand’s business activities. Customer demand remains high for both ICE and electric models.

Further sharp rise in unit sales of all-electric models

53,400 all-electric vehicles (BEVs) were delivered in the first three months (+74 percent). The fully electric ID.4 plays a key role in this. More than one in two electric vehicles delivered was an ID.4, of which 30,300 units were handed over to customers. Volkswagen is now pressing ahead with the expansion of production capacity for its best-selling electric car. On May 20, 2022, the plant in Emden will start series production of the ID.4, creating additional capacity for the successful model. The ID.4 will also roll off the production line in Chattanooga in the United States in the second half of the year. The models of the entire ID. family continue to enjoy buoyant demand, with over 120,000 customer orders being placed for the ID. models in Europe alone.

The backlog of orders across all drive types reached a historic high of more than 670,000 vehicles in Europe alone. The Group is therefore working hard on keeping delivery times for customers as low as possible and processing the large backlog of orders swiftly.

Financial figures for Volkswagen Passenger Cars

| | Q1 2021 | Q1 2022 | Change in percent |

| Sales revenue (€ billion) | 17.6 | 14.9 | –15.3% |

| Operating result before special items (€ million) | 490 | 513 | +4.7% |

| Operating return on sales before special items (%) | 2.8% | 3.4% | +23.6% |

| Net cash flow (€ million) | 365 | 92 | –74.7 |

Deliveries by Volkswagen Passenger Cars by region

| Q1 2021 | Q1 2022 | Change in percent | |

| Western Europe | 271,100 | 215,400 | –20.5% |

| Central and Eastern Europe | 53,800 | 34,000 | –36.8% |

| North America | 127,500 | 95,800 | –24.8% |

| South America | 109,200 | 52,300 | –52.1% |

| China incl. HK | 732,400 | 557,900 | –23.8% |

| Rest of Asia-Pacific | 29,500 | 30,200 | +2.1% |

| Middle East/Africa | 36,500 | 26,500 | –27.4% |

| | | | |

| Worldwide | 1,360,100 | 1,012,100 | –25.6% |

Media contacts