- Measures to boost cost effectiveness in a sustainable manner show effect

- Operating return on sales before special items increases to 5.6 percent

- Operating result before special items rises to EUR 1.9 billion

- Electric mobility strategy on track: 25 percent more all-electric cars delivered despite supply shortages and coronavirus restrictions

- Volkswagen CEO Thomas Schäfer: “We are making great strides. Gained considerable additional momentum in the second quarter. Cautiously optimistic about supplies in the second half of the year. Want to leverage further synergies between volume brands.”

- Volkswagen lifts outlook for operating return on sales before special items to 4 to 5 percent for full-year 2022

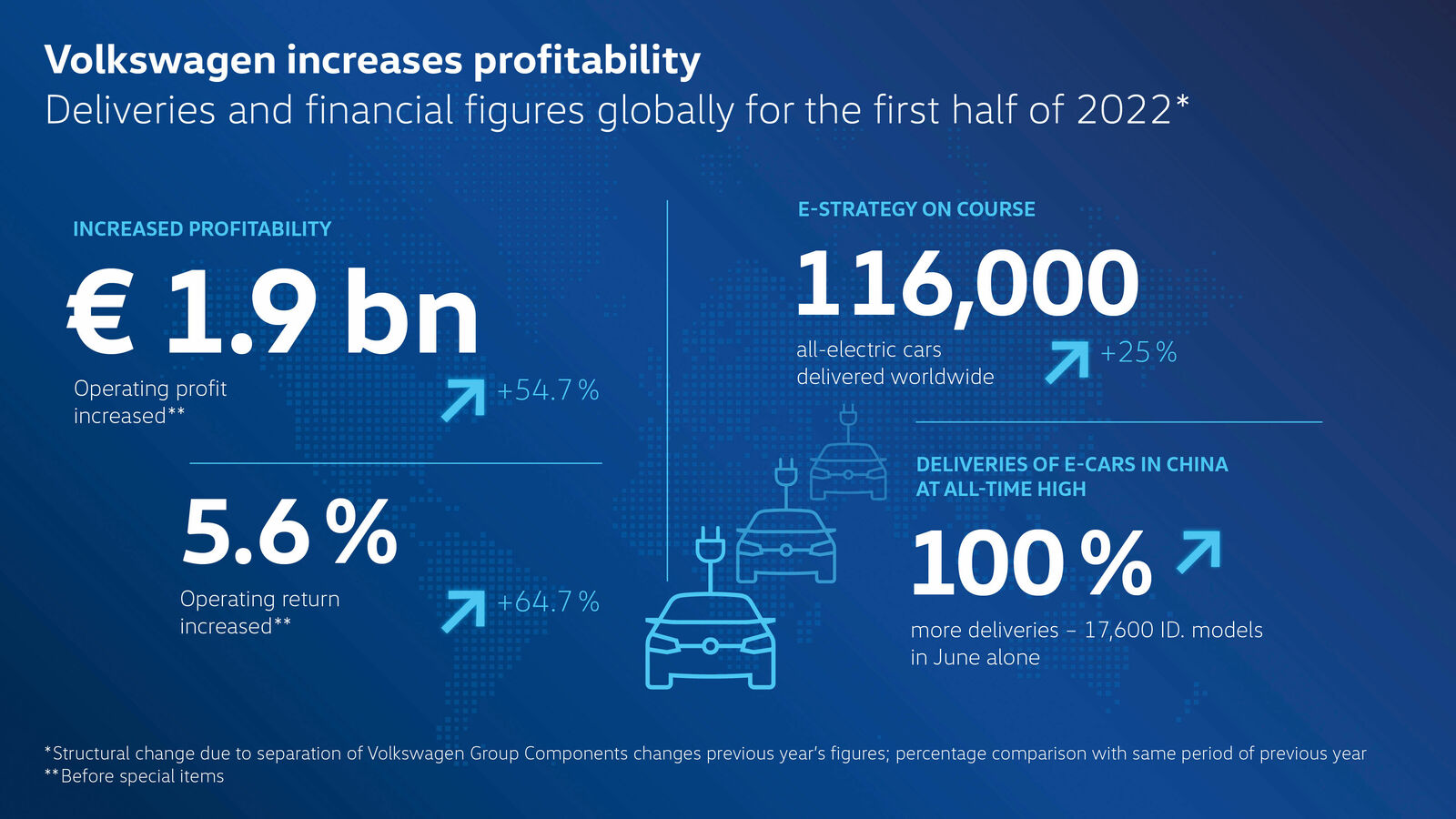

The Volkswagen brand further strengthened the Group’s economic efficiency in the first half of 2022. Effective sale management, improved cost efficiency and consistent implementation of the ACCELERATE strategy have led to a strong financial result. Operating result before special items rose to EUR 1.9 billion (first half of 2021: EUR 1.2 billion). The operating return on sales before special items rose to 5.6 percent (first half of 2021: 3.4 percent). The half-year result benefited in particular from a strong second quarter. This is also the main reason that the net operating cash flow reached 569 million euros in the first six months. As a result of optimized model and price policy, the company generated sales revenue of just under 33 billion euros (first half of 2021: 36 billion euros) – despite a significant year-on-year decline in vehicle deliveries.

Volkswagen CEO Thomas Schäfer: “We are making great strides in implementing our electric mobility strategy, digitalization and software, and picked up significant speed in the second quarter of 2022, despite the persistently strained supply situation. We continue to apply extreme cost discipline and will leverage even greater synergies at all levels within the Volume brand group. The aim is to increase efficiency by 20 percent for the entire Volume brand group in the medium term. For the second half of the year, we are cautiously optimistic that the supply situation will ease.” The Volume brand group, which comprises Volkswagen Passenger Cars, SEAT and CUPRA, ŠKODA as well as Volkswagen Commercial Vehicles, is under the responsibility of Thomas Schäfer in the Group Board of Management. The brands are to cooperate even more closely in future to become even faster, more effective and more cost-efficient – and to turn the large volume of vehicles they produce into a competitive advantage.

Focus on cost efficiency remains unchanged

Contributors to the financial result include the continued consistent drive to optimize fixed costs and distribution expenses, the ongoing encouraging trend in the regions – especially North and South America – as well as the investment focus on digitalization and electric mobility, which are key issues for the future. “Our measures to reduce costs and increase profit are having an effect, despite persistent geopolitical uncertainties, sharp rises in commodity and energy prices, disruptions to delivery and supply chains as well as the impact of the pandemic in China,” says Volkswagen CFO Alexander Seitz. “The upward trend continued in the second quarter.”

Volkswagen delivers 25 percent more all-electric cars

Due to the war in Ukraine, the global semiconductor shortage and the coronavirus pandemic in China, global deliveries amounted to 2.08 million vehicles (down 23.2 percent). The number of electric vehicles delivered meanwhile continues to grow: A total of 116,000 units means that 25 percent more all-electric cars were delivered than in the same period of the previous year. The clear front runner was the ID.4 – at around 63,000 deliveries – making every second BEV an ID.4. In China, Volkswagen’s deliveries of electric vehicles as much as doubled, and in June the number of vehicles in the ID. family reached a new record high, with 17,600 models delivered to Chinese customers.

Overall, demand remains high for both ICE and electric vehicles. The backlog of orders across all drive types stands at 728,000 vehicles for Europe alone, including around 139,000 all-electric ID.s. The Group is working hard on further reducing delivery times for customers and processing more of the large backlog of orders as quickly as possible.

Outlook for 2022 lifted – despite rising commodity and energy prices

“We expect the impact of commodity and energy prices to be significantly higher in the second half of 2022 than in the first half of the year. We are taking a bundle of measures to counter this trend. We are confident that we will largely be able to offset these price increases and continue our positive trend. We are for this reason lifting our outlook – providing that the supply situation develops according to expectations. For full-year 2022, we are now aiming for an operating return on sales before special items of 4 to 5 percent,” says Alexander Seitz. The full-year outlook was previously at up to 4 percent.

Financial figures for Volkswagen Passenger Cars

| | Jan. – June 2021 | Jan. – June 2022 | Change in percent |

| Sales revenue (€ billion) | 35.8 | 33.2 | –7.3% |

| Operating result before special items (€ million) | 1,202 | 1,860 | +54.7% |

| Operating return on sales before special items (%) | 3.4% | 5.6% | +64.7% |

| Net cash flow (€ million) | 622 | 569 | –8.5% |

Note: Structural changes as a result of separating out VW Group Components has led to changes in prior-year figures)

Media contacts