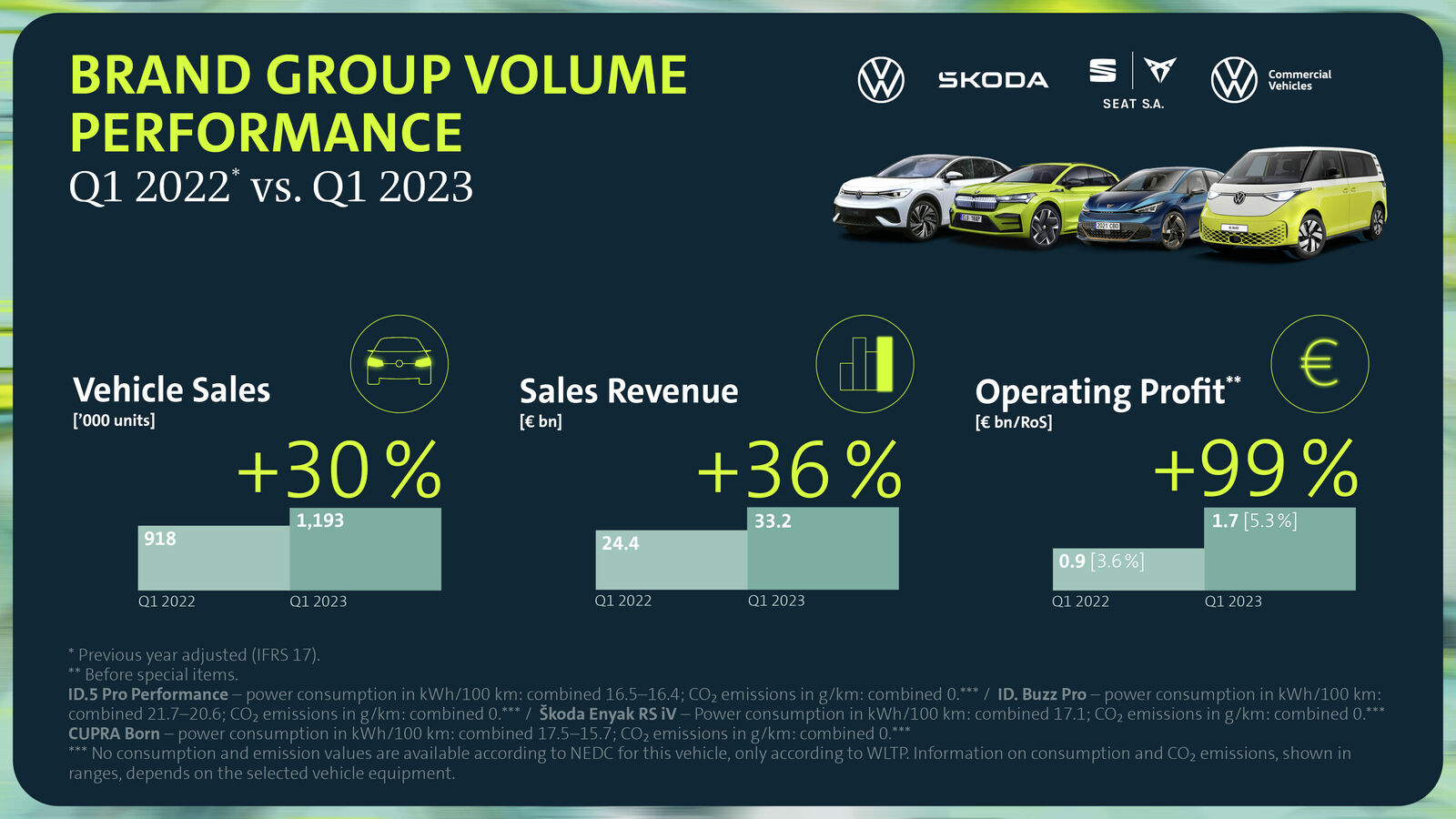

- Brand Group Volume sales revenue climbed to EUR 33.16 billion (+36 percent) in first quarter

- Strong growth in BEV deliveries (+ 49 percent) underscores progress in Brand Group Volume’s electric ramp-up – overall deliveries up 30 percent to 1.19 million vehicles

- Consolidated operating profit before special items doubled to EUR 1.74 billion; Brand Group Volume’s operating return on sales came in at 5.3 percent (+1.7 percentage points)

- Strong result driven by higher sales volume, consistent cost management and focus on efficiency in key synergy areas

- Thomas Schäfer, Member of the Volkswagen Group Board of Management in charge of the Brand Group Volume: “Strong brands, lean engine room: targeted cooperation between the brands enabled us to expand existing synergies and scaling benefits in the past few months and at the same time increase our financial robustness and innovation strength. The Brand Group Volume’s key figures prove we are on the right track.”

The Volkswagen Group’s Brand Group Volume further strengthened the close cooperation between the sister brands Volkswagen, Škoda, SEAT/CUPRA and Volkswagen Commercial Vehicles in the first quarter of 2023. To take account of this successful development and the significance of the Brand Group Volume in the ongoing transformation of the Volkswagen Group, the four volume brands are publishing their key financial metrics for the first time in a Brand Group Volume quarterly report.

The brand group’s positive development towards greater efficiency and profitability in the volume segment is reflected in particular by the operating profit before special items, which doubled compared with the prior-year quarter, coming in at EUR 1.74 billion (Q1 2022: EUR 0.88 billion), and by a sharp increase in the Brand Group Volume’s operating return on sales from 3.6 percent in the first quarter of the previous year to 5.3 percent in Q1/23. There was also a sharp increase in consolidated sales revenue, which grew 36 percent to EUR 33.16 billion (Q1 2022: EUR 24.36 billion), while net cash flow was EUR 1.7 billion (Q1 2022: EUR 0.5 billion), thus reflecting the good first-quarter performance.

Unit sales in the first quarter of 2023 increased 30 percent to 1.19 million vehicles (Q1 2022: 0.92 million vehicles). The full-electric model range accounts for an ever-larger share of deliveries. In total, the Brand Group Volume delivered 97,100 full-electric vehicles in the first quarter of the year, 49 percent more than in the prior-year quarter.

“Strong brands, lean engine room: targeted cooperation between the brands enabled us to expand existing synergies and scaling benefits in the past few months and at the same time increase our financial robustness and innovation strength. The Brand Group Volume’s key figures prove we are on the right track,” Thomas Schäfer, Member of the Volkswagen Group Board of Management in charge of the Brand Group Volume, said.

Overview of key figures for the Brand Group Volume:

| Key figures | Brand Group Volume Q1 2023 (+development) | Brand Group Volume Q1 2022 |

| Unit sales | 1,193,000 vehicles (+30 %) | 918,000 vehicles |

| Sales revenue | EUR 33.16 billion (+36 %) | EUR 24.36 billion |

| Operating profit before special items | EUR 1.74 billion (+99 %) | EUR 0.88 billion |

| Operating return on sales before special items | 5.3 % (+1.7 %pp) | 3.6% |

| Net cash flow | EUR 1.7 billion | EUR 0.5 billion |

Four strong brands lay basis for strong performance by Brand Group Volume

The convincing Q1 performance by the Brand Group Volume is also due to the successful development of the individual brands Volkswagen, Škoda, SEAT/CUPRA and Volkswagen Commercial Vehicles.

The Volkswagen brand reported a slight upward trend in deliveries. The Volkswagen Passenger Cars brand handed over a total of 1.02 million passenger cars to customers worldwide in the first quarter of 2023 (+ 0.9 percent). Full-electric vehicles accounted for a large share of this success: with unit sales of some 70,000 vehicles, the brand accounted for just under half of all BEVs delivered by the Group (+31.2 percent). Despite the challenging environment and persistent supply constraints, operating profit before special items in the first quarter of 2023 came in at EUR 608 million, an improvement on the figure for the prior-year quarter (EUR 513 million). Sales revenue rose from EUR 14.9 billion (Q1 2022) to EUR 20.5 billion (Q1 2023). This positive trend was in part offset by factors such as significantly higher material costs as well as exchange rate effects. As a result, the brand’s operating return on sales before special items in the first three months of the current fiscal year stood at 3.0 percent, 0.5 percentage points lower than the corresponding quarter in 2022.

Škoda Auto reported a strong first quarter and delivered 209.600 vehicles to customers worldwide (+12.6 percent). The all-electric Enyaq iV family was particularly successful, with deliveries rising by over 40 percent. The traditional Czech brand generated sales revenue of EUR 6.8 billion, up 33.3 percent on the same period in 2022. Operating profit before special items also increased by over 60 percent to EUR 542 million. At 8.0 percent, the return on sales was at a high level.

SEAT/CUPRA grew the number of electric vehicles delivered between January and March 2023 more than fourfold (+318.9 percent) to 9,200 units. Overall, SEAT/CUPRA delivered 125,218 vehicles in Q1/23.37 percent more than in the prior-year quarter (91,407), making this SEAT’s strongest first quarter ever. The company reported an operating profit of EUR 144 million for the period January – March 2023, an improvement of EUR 139 million on the first quarter of 2022. The operating return on sales in Q1/23 rose to 4.0 percent. Thanks to high demand and improved components supply, sales revenue increased to EUR 3.6 billion (+48.2 percent compared with the prior-year quarter).

Volkswagen Commercial Vehicles continued the positive business trend of 2022 in the first quarter of fiscal year 2023. Deliveries grew 18.7 percent to 97,189 vehicles. Q1/23 was the first full business quarter for the ID.Buzz since its market launch, lifting deliveries of all VWN BEV vehicles to 5,500 units (Q1 22: 700 BEVs). Sales revenue rose to just under EUR 3.6 billion, driven by positive pricing and mix effects. Even though the market and supplier situation remained tense, operating profit before special items soared to EUR 171 million (Q1/22: EUR 46 million). In line with these figures, the operating return on sales increased from 2 percent in the first quarter of the previous year to 4.8 percent.

Outlook

The Brand Group Volume is the crucial lever for financial robustness, synergies and innovation in the Volkswagen Group – and bolsters resilience against external challenges. Based on effective management of the Brand Group Volume with lean structures, the focus is on reducing complexity – and the systematic leveraging of existing synergy potential. The central performance indicator for Brand Group Volume is a consolidated operating return on sales of 8 percent from 2025. For the 2023 fiscal year, the brand group already expects a consolidated operating return on sales significantly higher than the 3.6 percent posted for 2022.